Driver's certificate suspension or cancellation - In The golden state, you are called for to acquire and preserve SR22 insurance status for three years. As long as you keep this condition throughout the 3 years, your suspension is non-active, and also you can drive to an IDD or restricted license. However, failing to obtain this insurance coverage, your permit will get suspended or revoked from the original day of the hearing.

Ineligibility for reinstatement of your chauffeur's permit - In California, you are anticipated to have an SR22 for your license to get reinstated. If you stop working to get the SR22, you will certainly not be qualified to restore your driving benefits. Increased duration of an SR22 need - You need to preserve your SR22 condition consistently for 3 years in California.

What is SR-22 insurance? You might have heard an SR-22 referred to as "SR-22 insurance coverage," it isn't an insurance plan.

The Buzz on Oklahoma Sr22 Insurance Information & Quotes - Dui Process

An SR-22 is a certificate an item paper or electronic document your insurance policy business submits on your behalf with the state after your permit has been suspended. Maintain reading to discover even more concerning exactly how to discover the finest SR-22 insurance for you.

If you aren't certain whether you require an SR-22, below are usual factors the type could be called for: DUI or DWI sentence, Ticket for driving without insurance, Severe auto accident, Suspended or withdrawed certificate, Too many points on your certificate, SR-22s and insurance policy: what's following? The majority of states just call for motorists to hold an SR-22 for 3 years, as long as they steer clear of significant relocating offenses throughout that period.

Most states need your car insurer to submit the SR-22 directly. If your current car insurance firm isn't happy to file the SR-22 for you, you may need to discover a brand-new auto insurance policy service provider. If you're purchasing automobile insurance policy, be conscious that your insurance coverage may need to fulfill some additional requirements.

9 Easy Facts About Duis And Car Insurance: What You Need To Know - Greenberg ... Explained

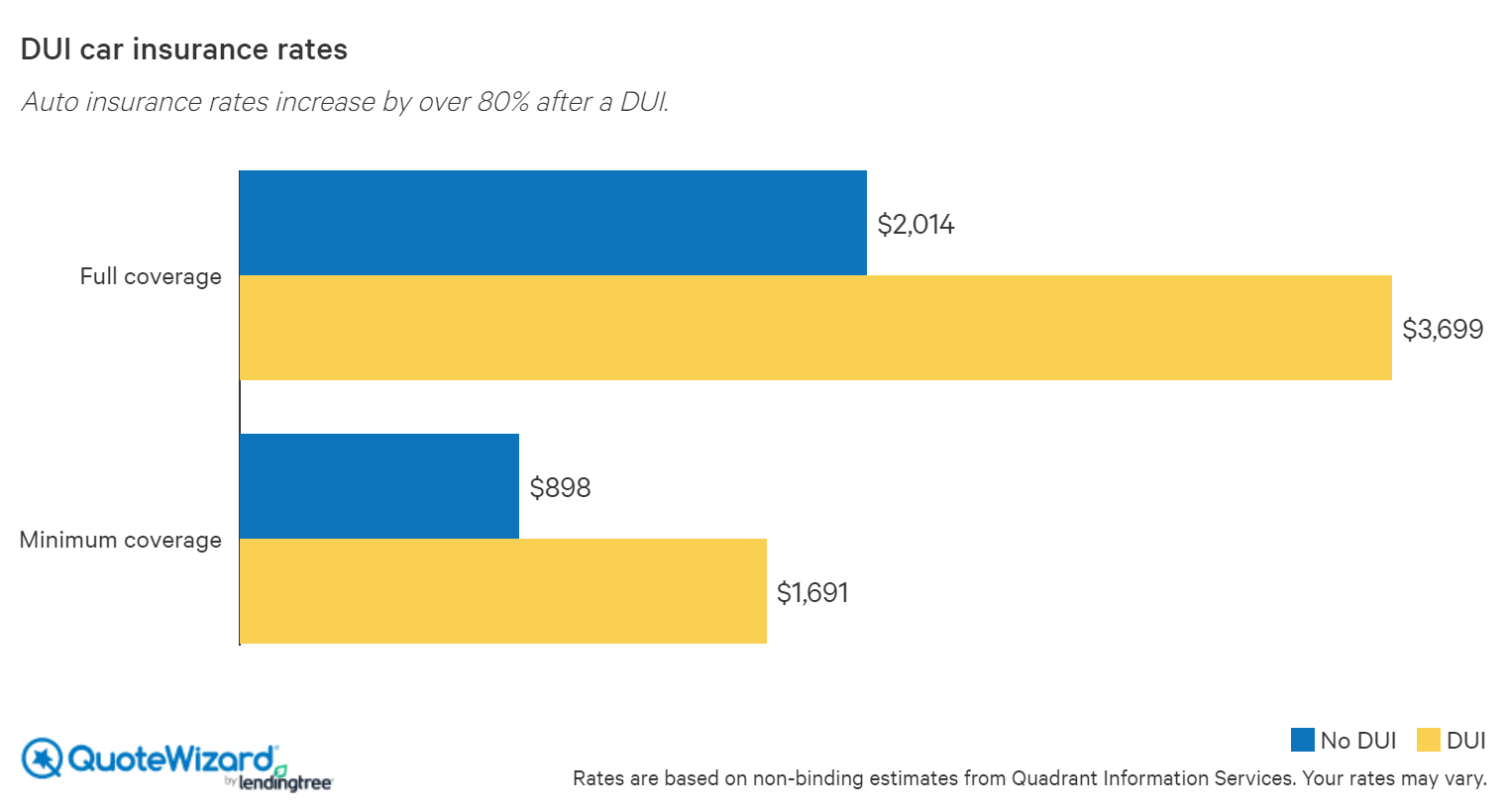

Exactly how a lot does an SR-22 price for insurance coverage? Filing for an SR-22 is relatively low-cost. Many insurance provider will charge a declaring fee of $15 to $35. The key price is related to the automobile insurance policy consequences of an SR-22. To an insurer, a motorist with an SR-22 or a driver in requirement of one is riskier than one without.

What happens if I have a gap of coverage with an SR-22? In states that require SR-22s, you will require to preserve constant insurance coverage with an SR-22 for 2 to 5 years relying on the state you stay in and the factor for the SR-22. If you have a lapse of coverage of any kind of kind, your insurer is legally bound to alert the DMV and your permit will certainly be put on hold.

If one is founded guilty of a DUI with a BAC (blood alcohol material) of more than 0. 15, he or she will be required to make use of an ignition interlock device for a minimum of thirty day. If one is founded guilty of a second or Go to the website subsequent DUI, he or she will certainly be needed to make use of an ignition interlock device for a minimum of 6 months.

Some Ideas on Orange County Sr22 Insurance Information - Orange County ... You Need To Know

Prior to you can start your vehicle, you have to blow into the IID. As soon as the device chooses you have not been drinking, it will certainly enable your car to start. Once your car begins, the tool remains to request for retests randomly periods. It is relatively simple to supply these samples, yet the tool is configured to enable a few mins in instance you need to pull over to utilize the gadget.

The IID also records any kind of circumstances in which you do not provide a sample when asked to do so. You need to not allow anyone else to drive your IID-equipped car unless you are absolutely certain that he or she will take the demands seriously, as the tool, and the records, do not differentiate in between one chauffeur and another.

What it is and also when a vehicle driver has to obtain SR-22 insurance policy protection. All states call for drivers to bring automobile liability insurance or another form of proof of financial duty. Financial duty regulations make sure that chauffeurs have the capability to spend for property problems as well as injuries resulting from automobile mishaps.