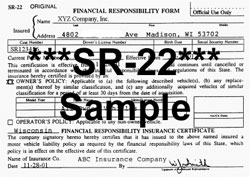

What is an SR-22? An SR-22 is a certification of monetary responsibility required for some chauffeurs by their state or court order. An SR-22 is not a real "kind" of insurance coverage, yet a type filed with your state. This kind acts as evidence your car insurance coverage fulfills the minimum liability protection needed by state legislation.

Do I require an SR-22/ FR-44?: DUI convictions Reckless driving Mishaps created by uninsured vehicle drivers If you need an SR-22/ FR-44, the courts or your state Electric motor Automobile Department will notify you.

Present Clients can call our Client Solution Division at ( 877) 206-0215. We will certainly review the coverages on your plan as well as start the procedure of submitting the certificate on your behalf. Exists a charge associated with an SR-22/ FR-44? Most states bill a level charge, but others need an additional charge. This is a single cost you have to pay when we file the SR-22/ FR-44.

A filing charge is billed for each specific SR-22/ FR-44 we file. For instance, if your partner is on your policy and both of you need an SR-22/ FR-44, then the declaring charge will be charged two times. Please note: The charge is not consisted of in the rate quote due to the fact that the declaring charge can differ.

Not known Factual Statements About What Is Sr-22 Insurance And Who Needs It? - Credit Karma

Your SR-22/ FR-44 should be valid as long as your insurance coverage policy is energetic. If your insurance coverage plan is canceled while you're still called for to carry an SR-22/ FR-44, we are called for to alert the correct state authorities.

Insurance coverage is everything about being prepared and also safeguarded for the unanticipated. So, if you're told you require to get an SR22, SR 22 insurance policy, or an SR-22 kind, would you recognize what to do? We're here to assist. Most individuals do not understand specifically what an SR22 is up until they need one.

Some people describe it as SR 22 car insurance coverage, or a certification of economic obligation (CFR) declaring. The SR22 just specifies you're fulfilling your state's cars and truck insurance protection demands for driving over a specified quantity of time. SR22, SR-22, SR 22, SR22 kind: Is everything the exact same? Yes, despite exactly how you reference SR22, all the Go to the website above examples describe SR-22 car insurance for vehicle drivers.

Who requires an SR22? You might require SR22 coverage if you have among the complying with driving infractions (your state may additionally need them for factors not listed here): Careless driving At-fault crashes Driving without insurance coverage Driving with a suspended certificate You could additionally require an SR-22 if you have a lot of little cases accumulate in time.

The 8-Second Trick For What Is Sr-22 Insurance? - Autobytel.com

Is an SR-22 thought about automobile insurance? An SR 22 means you're satisfying your state's cars and truck insurance coverage minimum requirements for driving and is NOT taken into consideration automobile insurance coverage itself.

Exactly how long does an SR 22 last? Many states call for vehicle drivers to have SR22 protection together with an insurance coverage for concerning three years. This might differ by state or by situations, so make certain to check your state's requirements as well as ask your insurance policy provider for specifics. Suppose my plan terminates? If your SR-22 gaps, your insurance firm is required to speak to the Division of Electric Motor Autos (DMV).

What types of SR 22 certificates are there? There are three types of SR22 insurance policy: A Driver's Certification is developed for chauffeurs who obtain or rent an auto, yet do not possess a vehicle.

If you're not certain of these demands, we advise calling your state's Department of Insurance policy. SR22 vs. FR44: What's the difference?

Little Known Questions About Texas Sr-22 Certificate, High Risk Driver Insurance.

And also right here are Virginia's cars and truck insurance demands. Similar to an SR 22, the FR-44 is a file of financial obligation verifying that you bring vehicle insurance. Nevertheless, an FR 44 might require your obligation protection restrictions to be dramatically more than the state minimum. While the period could differ, an FR44 is additionally generally needed for 3 years.